As the Coronavirus pandemic continues to tighten its grip on global markets, a decline, the likes of which haven't been seen since the 2008 financial crisis, is being monitored constantly. Yet, one market at least is continuing to thrive through this unprecedented time. The vintage watch community has seen that that demand for vintage timepieces is still very much alive and well, with online auctions continuing around the world.

Similarly to many industries, the watch industry has been massively affected by the COVID-19 pandemic and the resulting lockdowns put in place throughout the world. Some of the biggest brands in the watch world, including Patek Philippe, Tudor, and Rolex, have canceled the announcement and release of new models this year.

However, some areas of the market have actually managed to improve their sales. Sotheby's - one of the largest auction companies in the world - is one of the companies that has managed to sell more watches since the pandemic took hold in the western world. Josh Pullen, the global managing director of Sotheby's, outlined the 'curve' of the market: "Originally, online [auctions were] for lower price points for our business. But in the last month, we've really exponentially moved up the curve."

Despite many businesses retreating in the current financial climate, Sotheby's has introduced its new weekly format to allow it to storm through its inventories. Although this tactic might have seemed risky at first, it has apparently paid off. For two weeks in a row, the online auctions have broken the firm's record for most expensive watch sold online!

Towards the end of March, Sotheby's online auction sold a Rolex Paul Newman Daytona sold for around $167,188. The price was almost doubled at the next auction by another Rolex Daytona, which sold for roughly $306,378.

Although not every retailer will have seen a spike in sales over the last month, it does seem that the luxury watch market isn't taking quite the hit that might have been expected. After all, watches can be seen as a luxury item, even when we are not facing financially uncertain times. However, it appears that this trend may only apply to a particular area of the retail market.

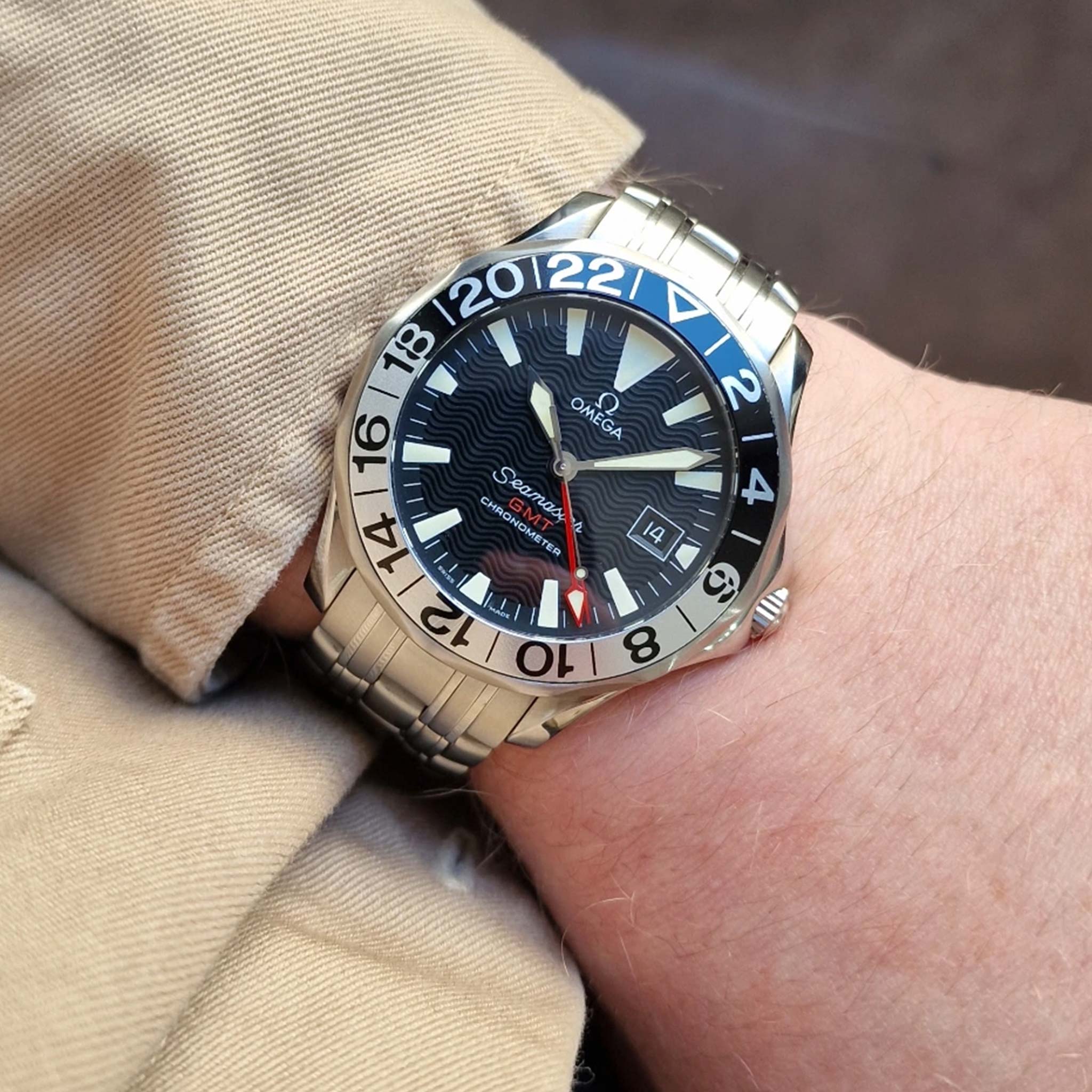

The more common purchaser - those who have slowly saved up for a classic Rolex Submariner or, perhaps, Omega Speedmaster - who want to invest in a watch that will last them for the rest of their lives, are the buyers that have declined over the last couple of months. Adam Golden, the owner of Menta Watches, suggests: "Obviously, there are a lot of people, especially in that $30,000-or-under price point, who were saving up to buy that $10-15,000 watch, which is a big purchase for them. Right now, it's not a priority.”

However, despite this loss to the market, the rich - those that have enough money to not feel the squeeze of the impending recession - have not been deterred from continuing their timepiece collections. Others are choosing to invest in watches while the stock markets remain unpredictable and volatile. One customer in Germany, for example, is seeking to build up a $300,000 stockpile in luxury "stable" watches.

Gold continues: "The market appetite at the top end seems to be robust.” And with Sotheby's currently listing watches like Patek Phillippe Nautiluses with bids upwards of $50,000, they are certainly catering to this end of the market.

The confidence in the watch market is seemingly not unfounded. Following the financial crisis of 2008, the watch market wasn't completely immune, as Golden puts it, "yeah, prices dropped, but then they went right back up." Further, it seems that vintage watches, more so than modern ones, are preferable for investment buyers. Why are vintage watches more popular, when their performance isn't better than modern models? They are already out of production, making them more limited, and so, more appealing. Many watch collectors believe that watches like these are a foolproof place to put their assets, and could even save them, in times of financial turmoil.

Another possible contribution to the apparent boom in watch buying? The gift of time. The COVID-19 pandemic has a lot of negatives, but perhaps one of the positive impacts for some is the extra time they have on their hands. Collecting watches can be a hobby like any other to some, so, what's to stop people indulging more time, and in some cases, more money, in this hobby? With people spending more time on the internet, and retailers pushing online sales more than ever before, perhaps the boom is not surprising as it might seem.

However, being mindful is always a benefit. Although sales might be staying strong for many at the moment, the long-term effects of the crisis are yet to be seen. Golden concludes that "the watch market, like every other business, is going to be down. It's just unavoidable —nothing in this world is bulletproof, especially right now.” The hope remains, however, that this is one industry that is destined to bounce back, just as it did in 2008.